What Is Keynesian Economics Theory and How Is It Used?

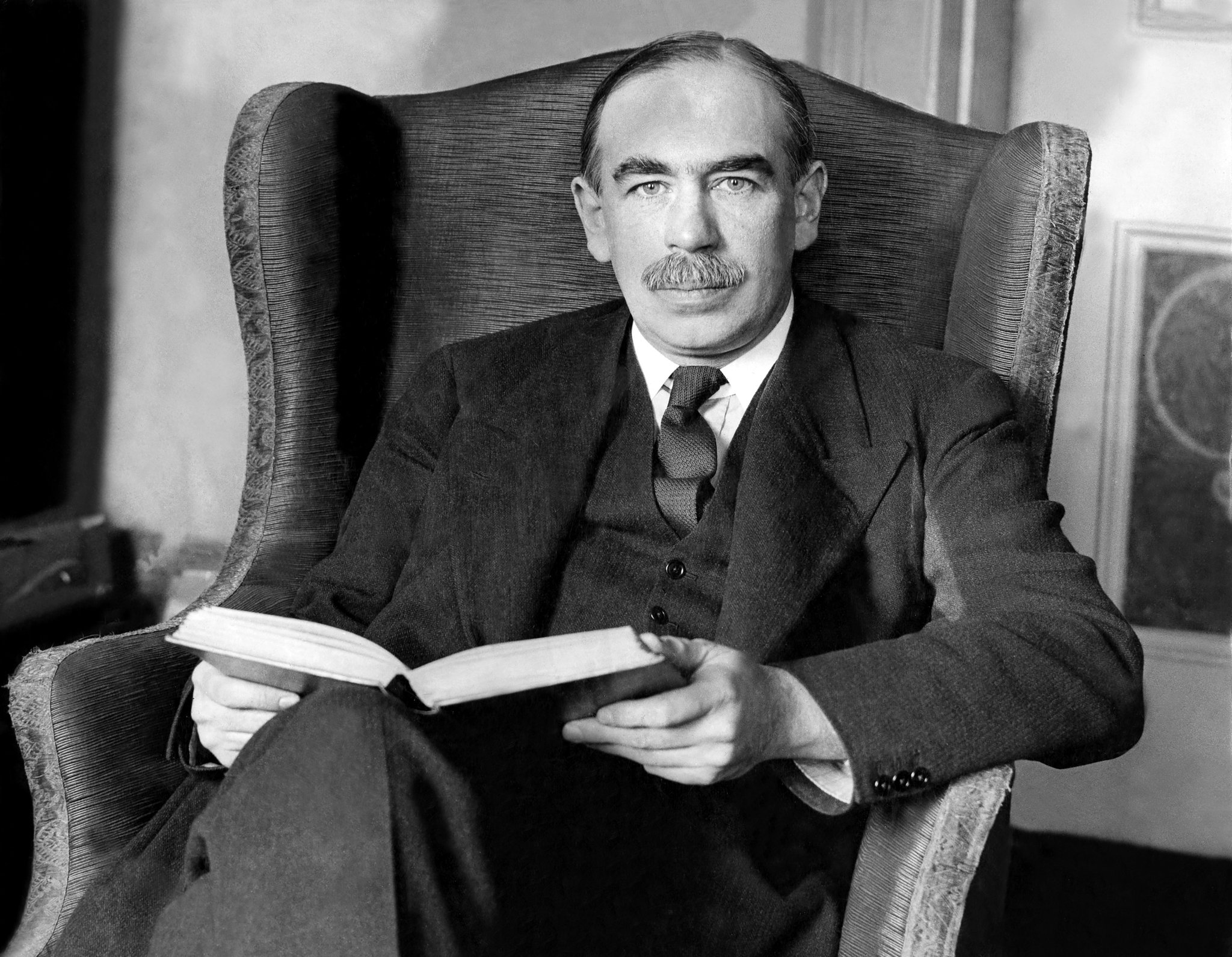

Who was John Maynard Keynes?

The father of modern macroeconomics and the creator of Keynesian economics, John Maynard Keynes (1883–1946) was a British economist. Keynes received an undergraduate degree in mathematics from Cambridge University in 1905 after attending one of the most prestigious institutions in England, King’s College. Despite having a strong maths background, he had little formal economics training.

What Is Keynesian Economics Theory?

A macroeconomic theory of the economy’s overall expenditure and its impacts on output, employment, and inflation is known as Keynesian economics. British economist John Maynard Keynes created the Keynesian school of thought in the 1930s in an effort to comprehend the Great Depression.

The demand-side theory that emphasizes short-term changes in the economy is known as Keynesian economics. Its main tenet is that economic stabilization can be achieved through government involvement.

The study of markets and economic behavior driven by individual incentives was initially sharply divided from the study of large-scale national economic aggregate variables and constructs by Keynes’ theory.

Also Read: A Brief History of Economics

Keynes’ theory led him to propose higher government spending and lower taxes as a way to boost demand and rescue the world economy from the Great Depression. Later, the term “Keynesian economics” was used to describe the idea that the best possible economic performance could be attained—and economic downturns could be avoided—by affecting aggregate demand through activist stabilization and government economic intervention. Keynesian economists defend this type of intervention on the grounds that it promotes full employment and price stability.

IMPORTANT TAKEAWAYS

- According to Keynesian economics, economic recessions can be addressed or avoided by utilizing proactive government policy to control aggregate demand.

- Keynes was an outspoken opponent of earlier economic ideas, which he referred to as “classical economics,” and he created his views in response to the Great Depression.

- The main methods advocated by Keynesian economists to steer the economy and combat unemployment are activist fiscal and monetary policy.

Keynesian Economics Explained

Keynesian economics offered a fresh perspective on how to measure output, spending, and inflation. In the past, what Keynes called “classical economic thought” claimed that cyclical changes in employment and economic output created profit possibilities that people and businesses would be motivated to seek, and by doing so, they would fix the economic imbalances.

This so-called classical theory was created by Keynes, who proposed that if aggregate demand decreased in the economy, the ensuing weakening in employment and production would lead to a decrease in prices and wages. Employers would be encouraged to increase hiring and make capital investments by reducing inflation and pay levels, boosting employment and reviving economic development. But according to Keynes, the length and severity of the Great Depression put this theory to the test.

Keynes argued against his construction of the classical theory in his book The General Theory of Employment, Interest, and Money and other writings. He claimed that during recessions, business pessimism and specific traits of market economies would exacerbate economic weakness and cause aggregate demand to fall even further.

Keynesian economics, for instance, challenges the idea advanced by some economists that full employment can be restored by lowering wages because labor demand curves slope downward like all other normal demand curves.

Also Read: Effects of Imports and Exports on the Economy

Similar to this, unfavorable business conditions could lead businesses to cut back on capital expenditures rather than buy new plants and machinery at reduced prices. Additionally, this would result in less total spending and employment.

Depression-era and the Keynesian Economics

Since Keynes’ General Theory was created during a severe slump that affected not only his own United Kingdom but the entire world, Keynesian economics is frequently referred to as “depression economics.” Keynes’ comprehension of the Great Depression’s events, which Keynes believed could not be explained by classical economic theory as he portrayed it in his book, shaped the renowned 1936 book.

Other economists had maintained that, in the wake of any significant economic slump, firms and investors acting in their own self-interest by taking advantage of lower input costs would, unless blocked, bring output and prices back to a state of equilibrium. Keynes thought that this idea appeared to be refuted by the Great Depression.

Also Read: The US Economy and How it Works?

During this time, output was poor and unemployment remained high. Keynes’ new perspective on the nature of the economy was influenced by the Great Depression. He developed practical applications from these theories that might have effects on a society experiencing an economic crisis.

Keynes disagreed with the notion that the economy would naturally revert to equilibrium. Instead, he contended that once an economic slump occurs, regardless of the cause, the anxiety it inspires in firms and investors tends to become self-fulfilling, which can result in a protracted period of weak economic growth and unemployment.

In response, Keynes proposed a countercyclical fiscal strategy, according to which the government should engage in deficit spending during tough economic times to make up for the drop in investment and increase consumer spending to stabilize aggregate demand.

- In order to offset a budget deficit and boost consumer demand in the economy, Keynes suggested that the government spend more money and reduce taxes. This would result in a rise in economic activity overall and a decrease in unemployment.

Keynes opposed excessive saving unless it was done specifically for a goal like a retirement or education. He considered it to be risky for the economy because less money is available to spur growth the more money that is left sitting in the economy. This was yet another of Keynes’ theories intended to stop severe economic downturns.

Also Read: The Financial Crisis of 2007-08

Keynes’ strategy has drawn criticism from several economists. They contend that unless the government intervenes with pricing and wages, giving the impression that the market is self-regulating, firms responding to economic incentives will typically return the economy to a state of equilibrium.

Keynes, who wrote at a moment of severe economic downturn, was less confident in the market’s ability to return to its natural equilibrium. When it came to building a strong economy, he thought that the government was in a stronger position than market forces.

Fiscal Policy and Keynesian Economics

One of the main tenets of Keynesian countercyclical fiscal policy is the multiplier effect, which was created by Keynes’ student Richard Kahn. The fiscal stimulus hypothesis of Keynes states that an increase in government spending eventually results in increased corporate activity and additional spending. According to this hypothesis, spending increases overall output and increases revenue. The boost in the gross domestic product (GDP) that results from this could be much bigger than the initial stimulus amount if workers are ready to spend their extra income.

Also Read: 4 Economic Concepts Everyone Should Know

The Keynesian multiplier’s size is inversely proportional to the marginal propensity to consume. Its idea is basic. One customer’s purchase generates income for a firm, which uses it to pay for energy, materials, equipment, labor costs, acquired services, taxes, and investment returns. The cycle then continues as a result of that worker’s money being spent. Keynes and his supporters held the view that in order to achieve full employment and economic growth, people should spend more and conserve less.

According to this idea, every dollar spent on fiscal stimulus eventually results in the economic growth of more than one dollar. For government economists, who could now justify politically popular national spending initiatives, this appeared to be a major victory.

For many years, this theory dominated the field of academic economics. Later, it was demonstrated by other economists that the Keynesian model distorted the connection between savings, investment, and economic growth, Milton Friedman and Murray Rothbard. Even while most economists agree that fiscal stimulus is much less effective than the original multiplier model predicts, many still rely on multiplier-generated models.

Also Read: The Five Characteristics of an Inclusive Economy

One of the two major multipliers in economics is the fiscal multiplier, which is frequently linked to Keynesian theory. The money multiplier is the name of the other multiplier. The process of creating money as a result of a fractional reserve banking system is described by this multiplier. Compared to its Keynesian fiscal equivalent, the money multiplier is less controversial.

Monetary Policy and Keynesian Economics

Keynesian economics emphasizes demand-side remedies for downturns. A key tool in the Keynesian toolbox for combating unemployment, underemployment, and weak economic demand is government intervention in economic processes. Keynesian thinkers and proponents of limited government involvement in the markets frequently disagree due to the emphasis on direct government intervention in the economy.

- According to Keynesian theory, economies do not stabilize themselves fast and necessitate active intervention to increase short-term demand.

Keynesians contend that because wages and employment take longer to adjust to market demands, government intervention is necessary to keep them on track. Furthermore, they contend that when monetary policy interventions are made, prices do not immediately respond and instead alter gradually, giving rise to the monetarism school of Keynesian economics.

When prices fluctuate slowly, it is possible to utilize the money supply as a tool and adjust interest rates to promote borrowing and lending. Governments may influence the economy in a significant way by lowering interest rates, which will promote investment and consumption.

Also Read: What is an Economic System?

Interest rate reductions boost short-term demand, which boosts employment and service demand while reviving the economy. The fresh economic activity then fuels job creation and sustained growth.

Without intervention, according to Keynesian thinkers, this cycle is broken, which makes market growth unstable and vulnerable to extreme fluctuations. By encouraging companies and people to take out more loans, low-interest rates aim to boost the economy. The money they borrow is subsequently used by them. This additional spending boosts the economy. However, lowering interest rates does not always result in an immediate boost to the economy.

Monetarist economists strive to solve the economy’s problems by controlling the money supply and lowering interest rates, although they typically try to avoid the zero-bound issue. Since there is less incentive to invest and more to hoard cash or near substitutes like short-term Treasurys, cutting interest rates to stimulate the economy becomes less effective as they go closer to zero.

If interest rate manipulation is unable to encourage investment, it may no longer be sufficient to create new economic activity, and the effort to create an economic rebound may fail entirely. This kind of liquidity trap exists.

Keynesian economists argue that alternative measures, especially fiscal policy, must be taken when interest rate reductions are ineffective. Changing tax rates to indirectly boost or decrease the money supply, altering monetary policy, or restricting the supply of goods and services until employment and demand are restored are some other interventionist strategies.

THANKS FOR READING